Property Tax Calculator |

|

Disclaimer: This property tax calculator is provided for use by City of Myrtle Beach residents to estimate the potential savings to be realized through the implementation of the tourism development fee. The calculation methods used on this page are based upon current millage information exclusively for owner-occupied residences within the City of Myrtle Beach only Results received from this property tax calculator are designed for general comparison purposes only and are not reviewed nor approved by the Horry County Treasurer. Accuracy is not guaranteed. By using this calculator, the user acknowledges that the information provided herein is simply for general information and may differ from the actual figures provided by the Horry County Treasurer’s Office. For specific questions or information related to property taxes, please contact the Horry County Treasurer’s office at (843) 915-5470. |

|

| Instructions: Enter the appraised value (taxable) of your property in the top field, then click the "Calculate" button and the adjusted city property taxes will be calculated. | |

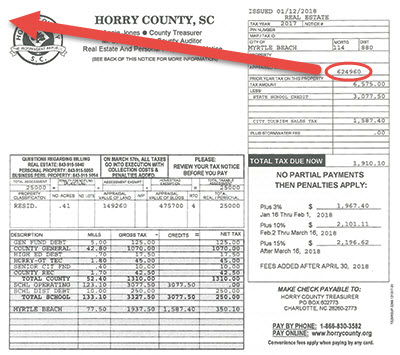

Sample Tax Notice: Appraised value is circled in red. |

|

Note: The estimated total property tax bill is the total of county, school and city property taxes. The adjusted total property tax includes the tourism tax credit. |

|